Car Storage

Locations & Pricing

Why Choose Us

How can we help?

Car Investors

HMRC Customs bonded warehouse

Windrush Car Storage Cotswolds and London are now recognised as official HMRC Customs Warehouses. This highly sought-after status offers the opportunity to delay payable duty and VAT on vehicle imports indefinitely.

What does it mean?

HMRC Customs Bonded Warehouse

Windrush Car Storage Cotswolds and London are now recognised as official HMRC Customs Warehouses.

This highly sought-after status offers the opportunity to delay payable duty and VAT on vehicle imports indefinitely.

As long as the vehicle remains in the care of Windrush, it will be exempt from duty usually demanded when bringing a vehicle into the UK. Duty will only become payable when a vehicle leaves the Windrush Customs Warehouse to be registered and used within the UK on a permanent basis.

Duty and VAT will be waived entirely if a vehicle is subsequently re-exported after being cared for by Windrush. To be eligible for this exemption, vehicles must be taken directly to Windrush when imported into the UK.

As long as the vehicle remains in the care of Windrush, it will be exempt from duty usually demanded when bringing a vehicle into the UK. Duty will only become payable when a vehicle leaves the Windrush Customs Warehouse to be registered and used within the UK on a permanent basis.

Duty and VAT will be waived entirely if a vehicle is subsequently re-exported after being cared for by Windrush. To be eligible for this exemption, vehicles must be taken directly to Windrush when imported into the UK.

Duty can be waived

Duty can be waived when importing vehicles (purchased overseas) as an investment. Vehicles of this type can be stored indefinitely but cannot be used on UK roads (with the exception of transportation for routine maintenance). Duty will need to be paid if subsequently sold within the UK, but will remain exempt if the vehicle is sold outside of the UK.

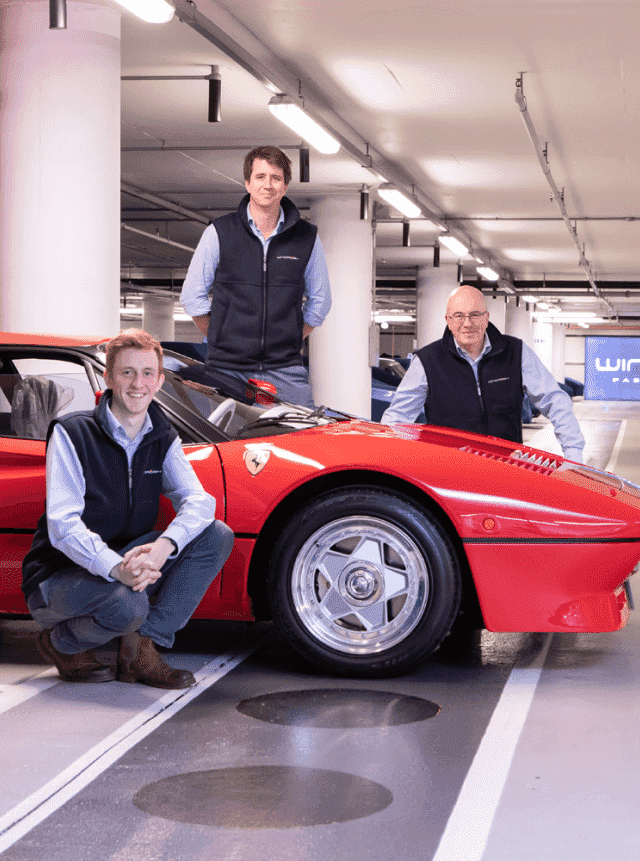

Store cars in the UK

Should an owner wish to store a car collection in the UK, Windrush can arrange global logistics, via its partner network, to accept the full collection safely and securely at the port before storing, maintaining, and caring for them indefinitely. Customs Warehouse status ensures the owner has absolute peace of mind without the having to pay import duty or re-register any vehicle.

Import from overseas

A customs warehouse provides the ability to import a vehicle from overseas before placing into temporary bond while the owner decides how they want to use the vehicle. If the car becomes an investment, it can stay in the Customs Warehouse until ready to be sold. If the car is sold outside of the UK, without ever having been officially imported or registered, no duty will be payable. If the owner chooses to register the vehicle in the UK, duty will be payable at that time.

Asset loan

Asset loan. A car may be imported to the UK solely to be used as security in an asset-funded loan. Overseas clients can take advantage of UK lending, using their vehicles as collateral, without the additional expense of import duty. Cars may still be maintained to manufacturers recommendations when in the care of Windrush.

Car storage services

Once a client of Windrush we offer to become your single point of contact for any of your automotive needs.

As featured in ...